For those who live, or are about to move ot Indiana, it is important to learn how local property taxes work and how those taxes shape total homeownership costs over time.

Indiana property taxes represent a recurring financial obligation tied directly to property ownership, added to mortgage principal and interest.

Budget planning works best when property taxes receive attention both before purchase and after closing.

Local communities rely on property taxes to maintain daily public operations, which directly affects the quality of life for homeowners.

Public services supported by Indiana property taxes include key community functions that buyers should recognize early in the process, including:

- Public school funding at local levels

- Police and fire protection services

- Welfare and assistance programs

- Road construction and maintenance

- Public library systems

Awareness of how Indiana property taxes support these services helps buyers evaluate long-term value tied to location.

What to Know About Property Taxes in Indiana?

Indiana property taxes function as an ad valorem system tied directly to the value assigned to real estate. Naturally, those who are interested in moving into the state should also pay attention to the overall costs of living.

Local government officials conduct annual assessments and apply tax rates based on approved budgets for each taxing district. Indiana property taxes supply a primary stream of funding for counties, cities, towns, school corporations, and special taxing units such as libraries and fire districts.

Ongoing reliance on property taxes makes them a central factor in how local services operate and remain funded year after year.

Administration of Indiana property taxes depends on coordination among several government offices throughout each tax cycle. Responsibilities are divided to promote accuracy, oversight, and accountability.

Primary participants involved in administering include:

- County assessors who determine assessed values using state guidelines

- County auditors and treasurers who calculate tax bills and manage collections

- Department of Local Government Finance staff who review assessments and approve tax rates

Coordination across these offices supports consistent application of Indiana property taxes across counties and municipalities while maintaining compliance with state law.

How Property Taxes Are Calculated

Assessed value represents the official valuation assigned to a property for Indiana property taxes. Indiana uses a market value in use standard, focusing on how a property functions rather than a hypothetical sale price.

Annual adjustment processes rely on local sales data to keep values aligned with current market conditions.

Changes in neighborhood sales activity can influence assessments even when no renovations occur.

Tax Rates and Local Levies

Local taxing districts adopt budgets that determine how much revenue Indiana property taxes must generate.

Counties, townships, cities or towns, and school corporations each contribute to the final tax rate. Calculation occurs after dividing required revenue by the total assessed value within each district.

Rate differences appear across counties due to variations in budget needs and property values.

Important factors that influence tax rates include:

- Size of local government budgets

- Total assessed value within district boundaries

- Number of taxing units tied to a property location

Property Tax Caps and Circuit Breaker Credits

Indiana law limits the growth of Indiana property taxes through tax caps tied to assessed value. Caps apply automatically during tax bill calculations and protect homeowners against excessive increases.

Caps apply by property classification in the following structure:

- 1% cap for homestead or owner-occupied property

- 2% cap for other residential property and agricultural land

- 3% cap for other real and personal property

Circuit breaker credits reduce tax liability when calculated amounts exceed these limits.

Knowing Your Property Tax Bill

Indiana property tax bills contain multiple data points that show how final amounts are calculated. Typical bills list assessed value, deductions, tax rates, credits, and net tax due. Indiana counties mail property tax bills annually, though due dates vary by location.

Reading a bill requires following a clear sequence. Review begins with assessed value, followed by deduction adjustments such as the homestead deduction. Local tax rates apply next to determine gross tax.

Circuit breaker credits may reduce that figure before reaching the final amount owed. Digital tools available through Indiana Gateway allow homeowners to view bill details and payment history online.

Homestead and Other Property Tax Deductions

Homestead deduction lowers the taxable value of a primary residence and up to one acre of land.

First-time buyers often qualify when planning to occupy the home as a main residence. Filing for the deduction reduces taxable value and lowers annual Indiana property taxes over time.

Eligibility relies on occupancy status rather than purchase history, making timely filing an important step after closing.

Other Deductions or Credits

Additional deductions or credits may apply based on the homeowner’s circumstances. Certain programs exist for seniors, veterans, and individuals with disabilities.

Circuit breaker credits linked to property tax caps also reduce Indiana property taxes automatically when calculated amounts exceed legal limits tied to property class.

Awareness of available programs helps homeowners avoid paying more than required under state law.

Indiana Property Taxes and the Homebuying Process

Indiana property taxes play a direct role in shaping total housing costs during every stage of the homebuying process. Early planning helps buyers avoid payment shock and supports realistic affordability calculations.

Estimating property taxes before making an offer allows buyers to compare homes more accurately and assess long-term financial obligations tied to ownership.

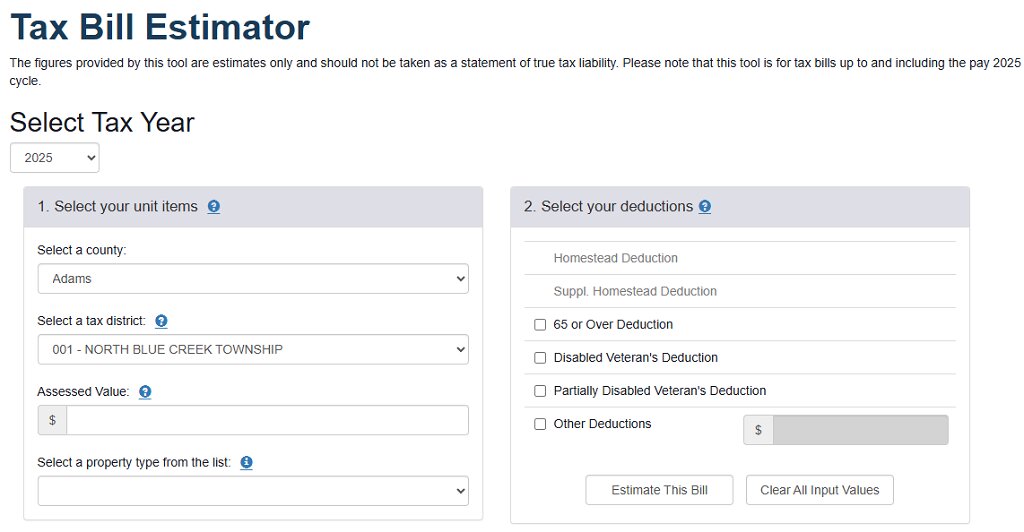

Online tools such as the Department of Local Government Finance Tax Bill Estimator and Indiana Gateway calculators provide projected tax amounts tied to specific addresses and recent assessment data.

Tax estimates matter most during budgeting and loan qualification, since lenders review total monthly obligations rather than mortgage payments alone.

Buyers benefit when estimates account for local tax rates, deductions, and caps rather than relying on prior owner payments that may no longer apply.

Several factors influence estimated Indiana property taxes during the buying phase, including:

- Current assessed value and recent neighborhood sales activity

- Eligibility for deductions such as the homestead deduction

- Local tax rates are tied to county, city, township, and school budgets

Closing transactions usually include property tax prorations that divide responsibility between buyer and seller. Allocation depends on local customs and the timing of tax payments relative to the closing date. Buyers may receive a credit or debit at closing to account for taxes already paid or owed for part of the year.

Mortgage financing adds another layer to how property taxes affect buyers. Many lenders require escrow accounts that collect estimated property taxes alongside monthly mortgage payments.

Escrow arrangements spread tax costs across the year rather than requiring large lump-sum payments when bills come due. Lenders rely on accurate tax projections to calculate escrow amounts and determine loan eligibility.

Accurate Indiana property tax estimates contribute to:

- More reliable monthly payment calculations

- Fewer escrow shortages or payment adjustments after closing

- Stronger confidence during underwriting and final loan approval

Challenging Your Property Tax Assessment

Submitting a challenge to an assessed value becomes relevant when a property valuation appears higher than the current market conditions support. Property taxes rely heavily on assessed value accuracy, making review worthwhile after receiving an assessment notice.

Requests may be submitted with the local assessor by June 15 of the assessment year or during the following year if no notice was received. Independent appraisals are not required to begin the process. Useful support materials often include:

- Recent comparable home sales

- Assessment records of similar nearby properties

- Photos or documentation showing the property’s condition

Careful preparation improves the likelihood of a successful outcome.

Summary

Clear knowledge of how local property taxes are calculated, how deductions and caps function, and how revenue supports local services allows first-time buyers to plan with confidence.

Tools available through Indiana Gateway and Department of Local Government Finance resources assist with estimating and tracking future obligations.

Combining Indiana property taxes with mortgage costs, insurance, interest, and down payment planning supports a complete financial view when purchasing a first home in Indiana.